Koggenhop v. Navient: AKA How I used design to win a case against one of the largest financial corporations in the United States of America.

"Navient will not accept an agenda-driven ultimatum based on false assertions & practices that will harm consumers... Navient will vigorously defend itself against unsubstantiated & politically motivated claims..." - Navient Corp., 1/18/2017 in response to the pending lawsuit brought against them by the Consumer Financial Protection Bureau (CFPB).

Below is an 81-page book presented to both the U.S. Department of Education and the Consumer Financial Protection Bureau backing my claim that Navient has violated federal law in their collection practices pertaining to my personal federal student loans. This book lead to multiple federal investigations into Navient Corp. and their business practices, one of which revealed that Navient doesn’t even collect on the loans that they are contacted to, but uses a third-party servicer (Bank of America) to collect on their behalf in order to skirt around the law.

The U.S. Department of Education emphasized that what solidified my case against Navient was:

• The easy-to-follow design and layout of hundreds of documents;

• The overwhelming quantity of evidence collected through documentation over a period of time;

• Finally, the refusal to accept that what Navient was doing to me was anything but unlawful.

The primary reason I am publishing this is to hopefully inspire anyone who has been a victim of Navient's abusive practices to come forward to the CFPB and aid them in the pending lawsuit. In addition, I would like to bring to light that even those of us who are going above and beyond to comply are being targeted by this company, and that when the effort is made by the borrower to resolve these issues on their own, Navient refuses to act.

Please note that there is rather strong language included in these pages both in the form of personal notes and direct explanations to provide additional context to what is being presented. I have also only included the most relevant pages pertaining to my case backing up the most outrageous things Navient has done to me over the years. The other pages contain (and are not limited to) evidence of Navient not meeting the standard of their servicing contract with the United States, personal thoughts on specific Navient employees, and interactions with the Department of Education and CFPB. Those pages will be made available upon request for credible entities only.

Navient has been made aware on several occasions since August 2016 of my intent to publish this book online. They have also been made aware that the reason for the delay is because I felt it important to protect the privacy of individual employees, and have spent more time checking and rechecking to make sure all information is not displayed than I did making this book. I believe that it is one thing to present names and ID numbers when saying, "this is who I talked to and this is what they said," to be used internally, but it's not okay to call out individuals publicly who were only doing their jobs. I'm not here to get anyone fired for following the company protocol.

Front Cover

Copyright & Disclaimer

Page 5: Table of Contents

Page 7: Introduction.

Page 9: How to use this book. An detailed explanation of my thought process while putting this together and how I intended to present the information.

Page 12

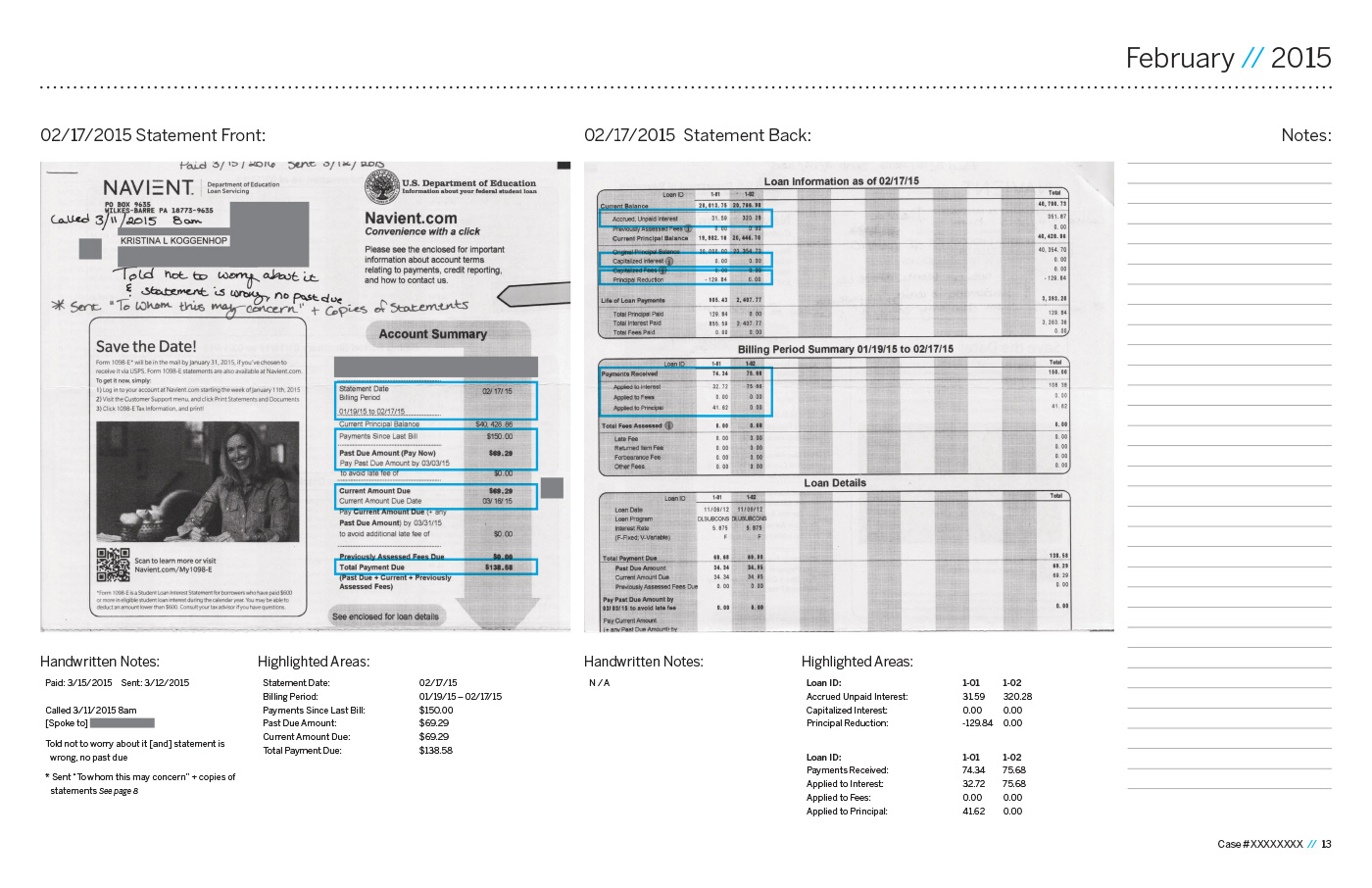

Page 13

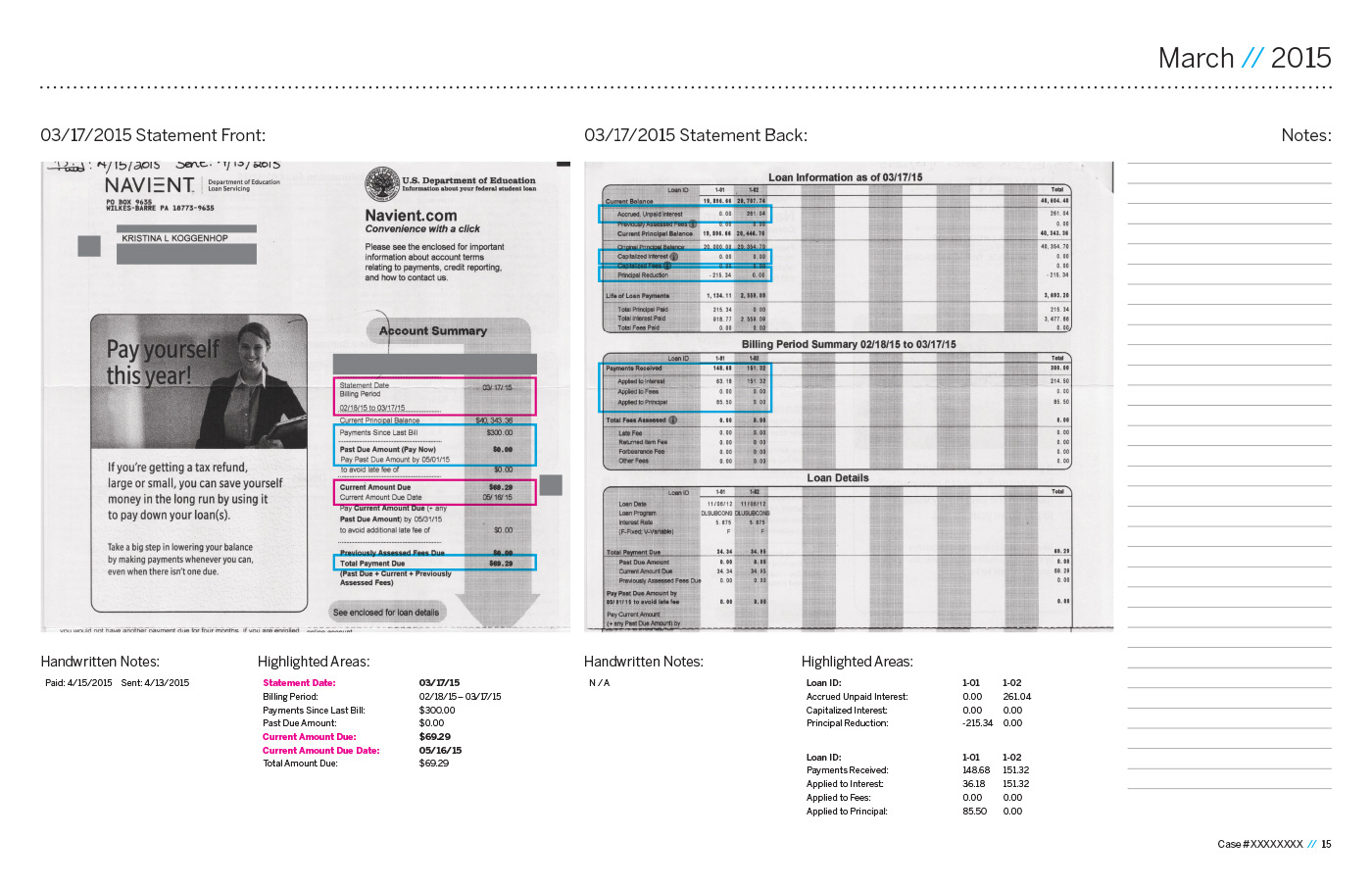

Page 15

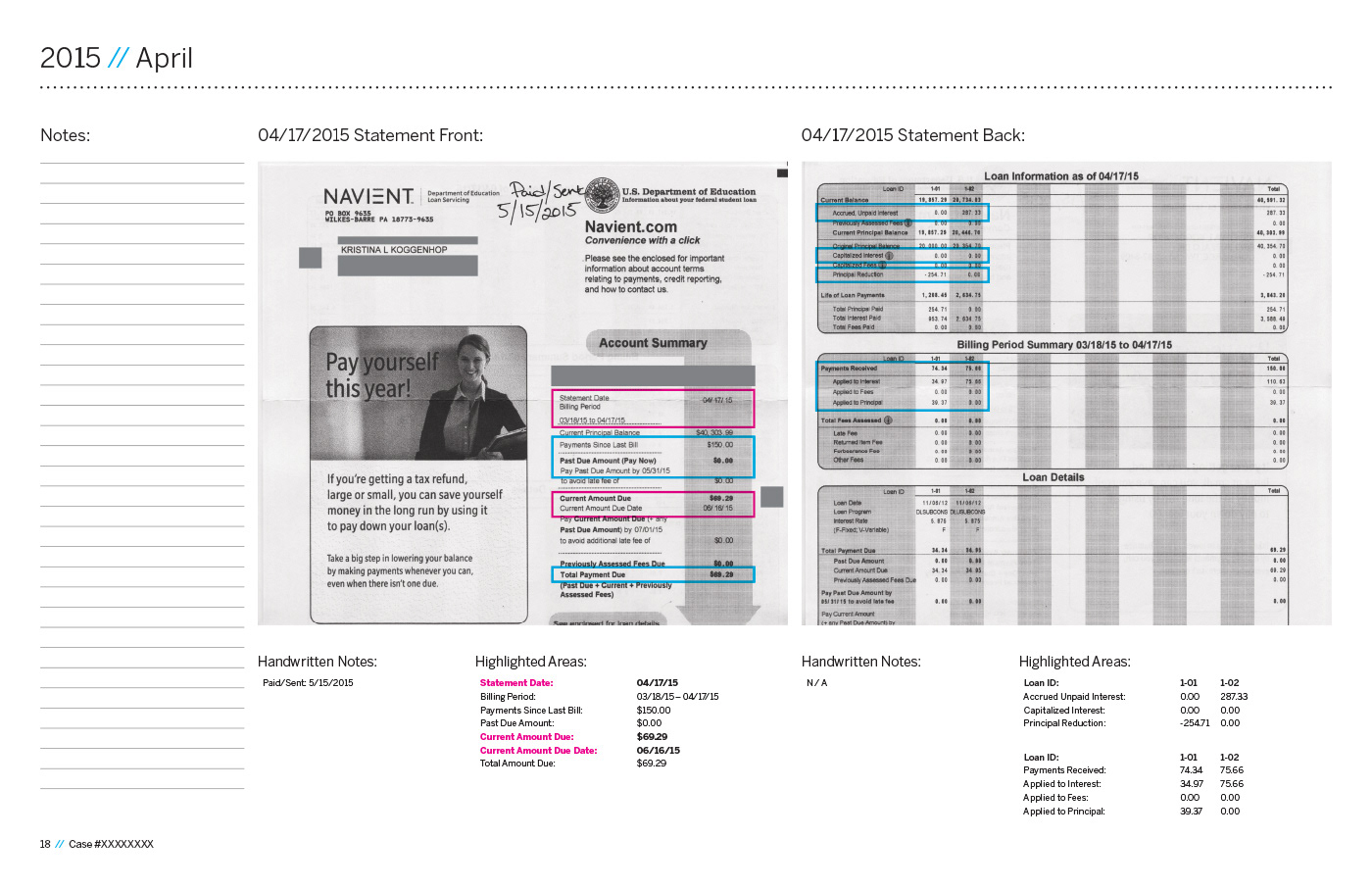

Page 18

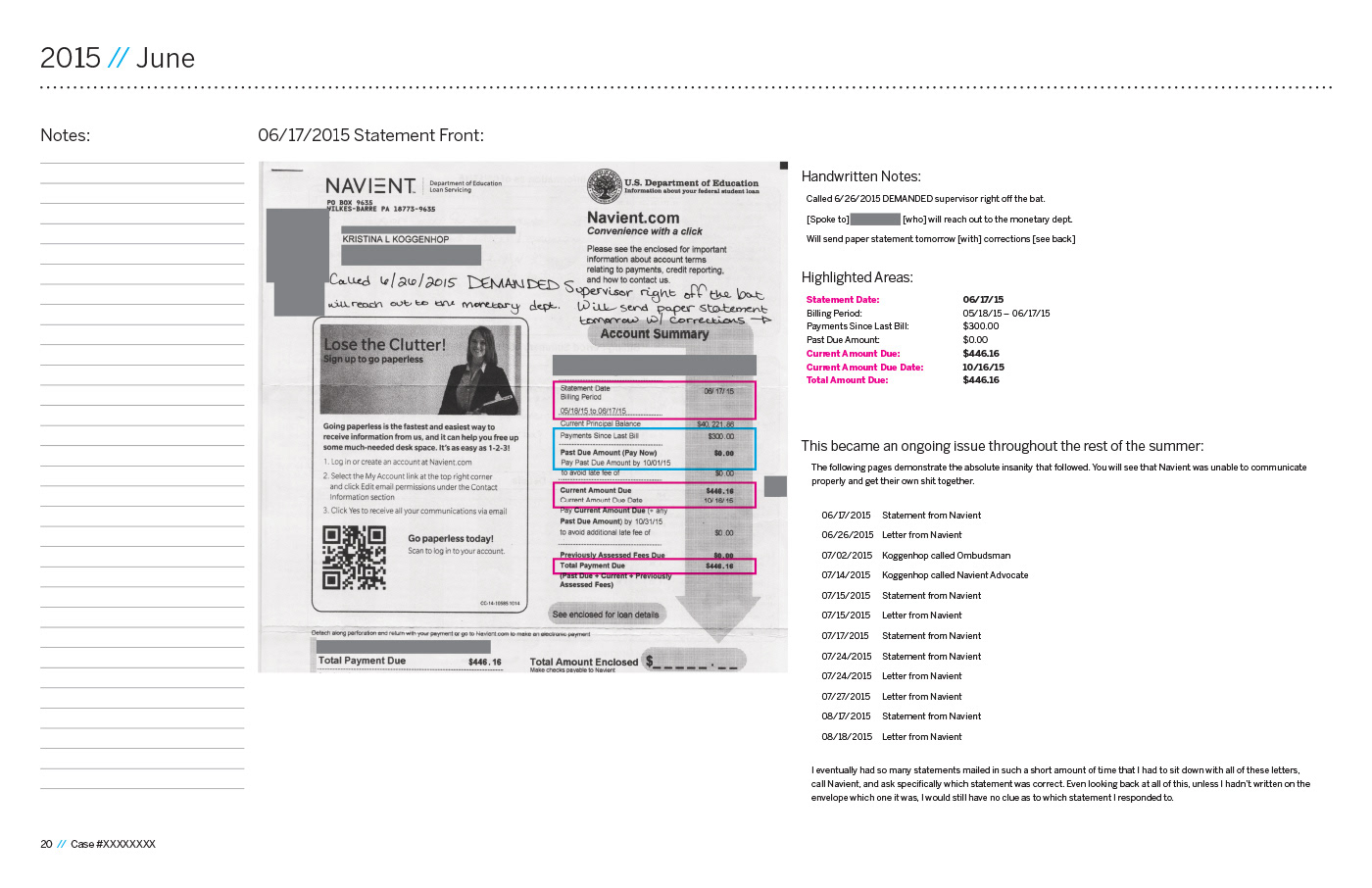

Page 20

Page 21

Page 22

Page 26: Please note the dates.

Page 27

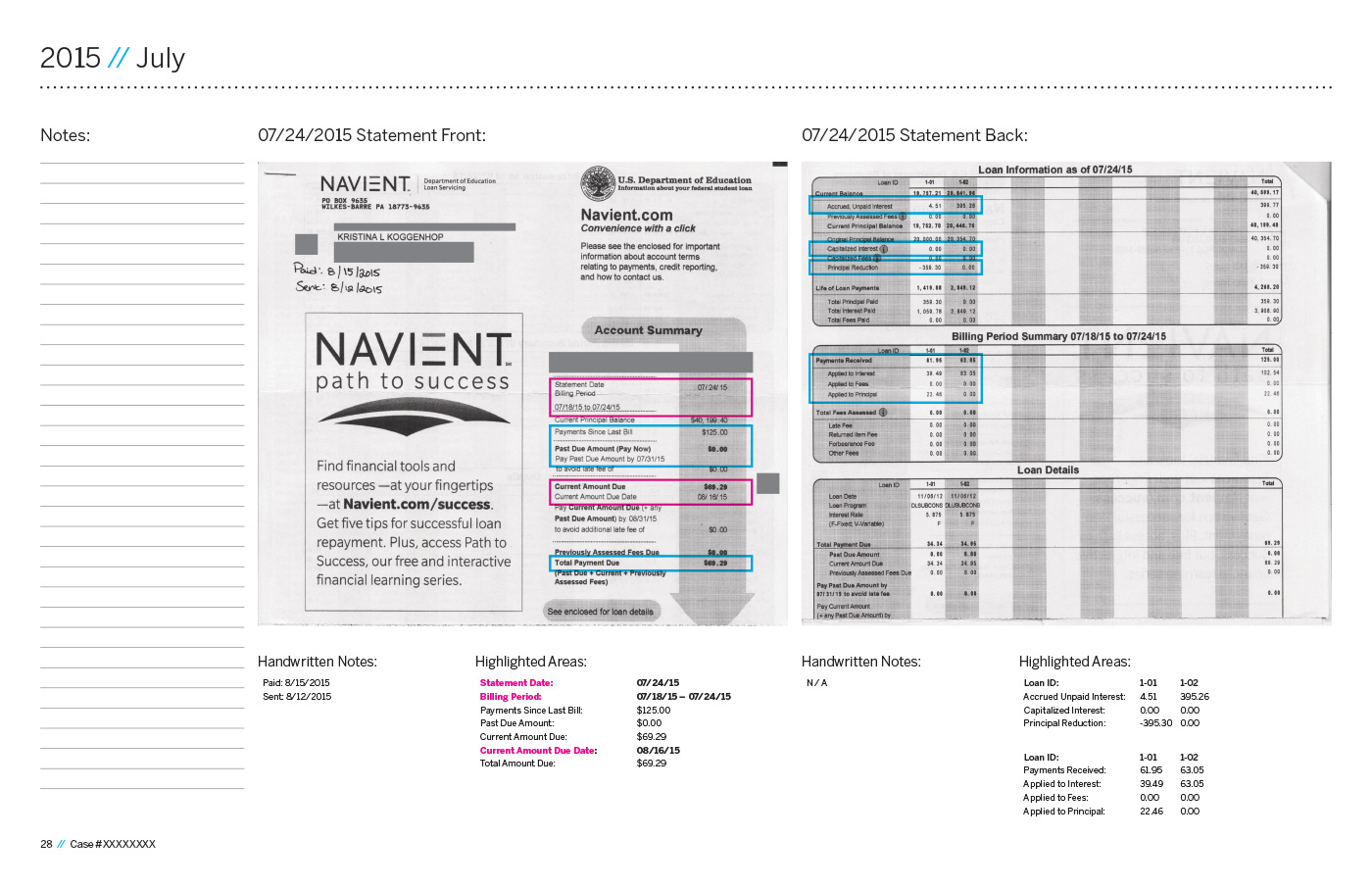

Page 28

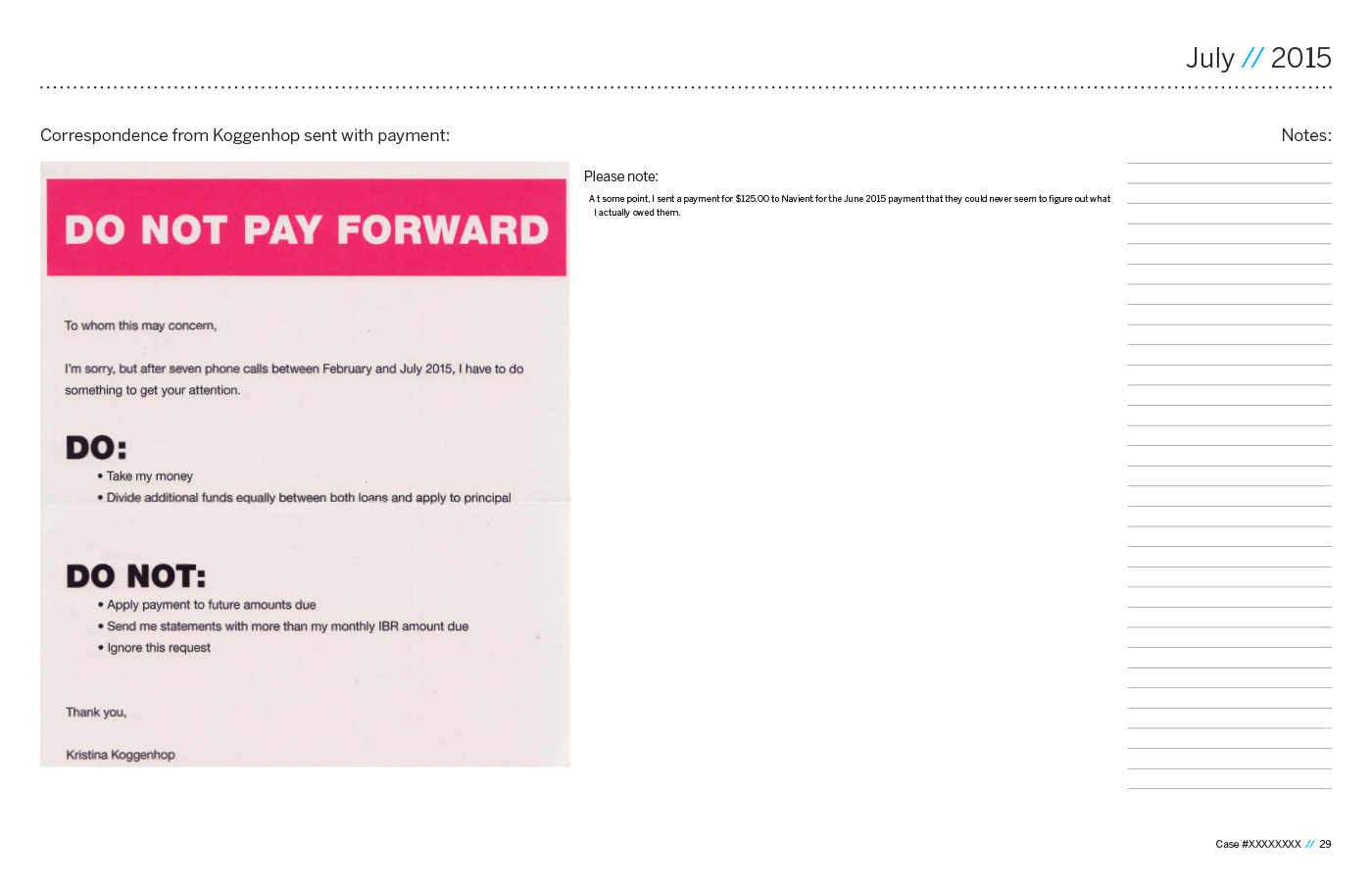

Page 29

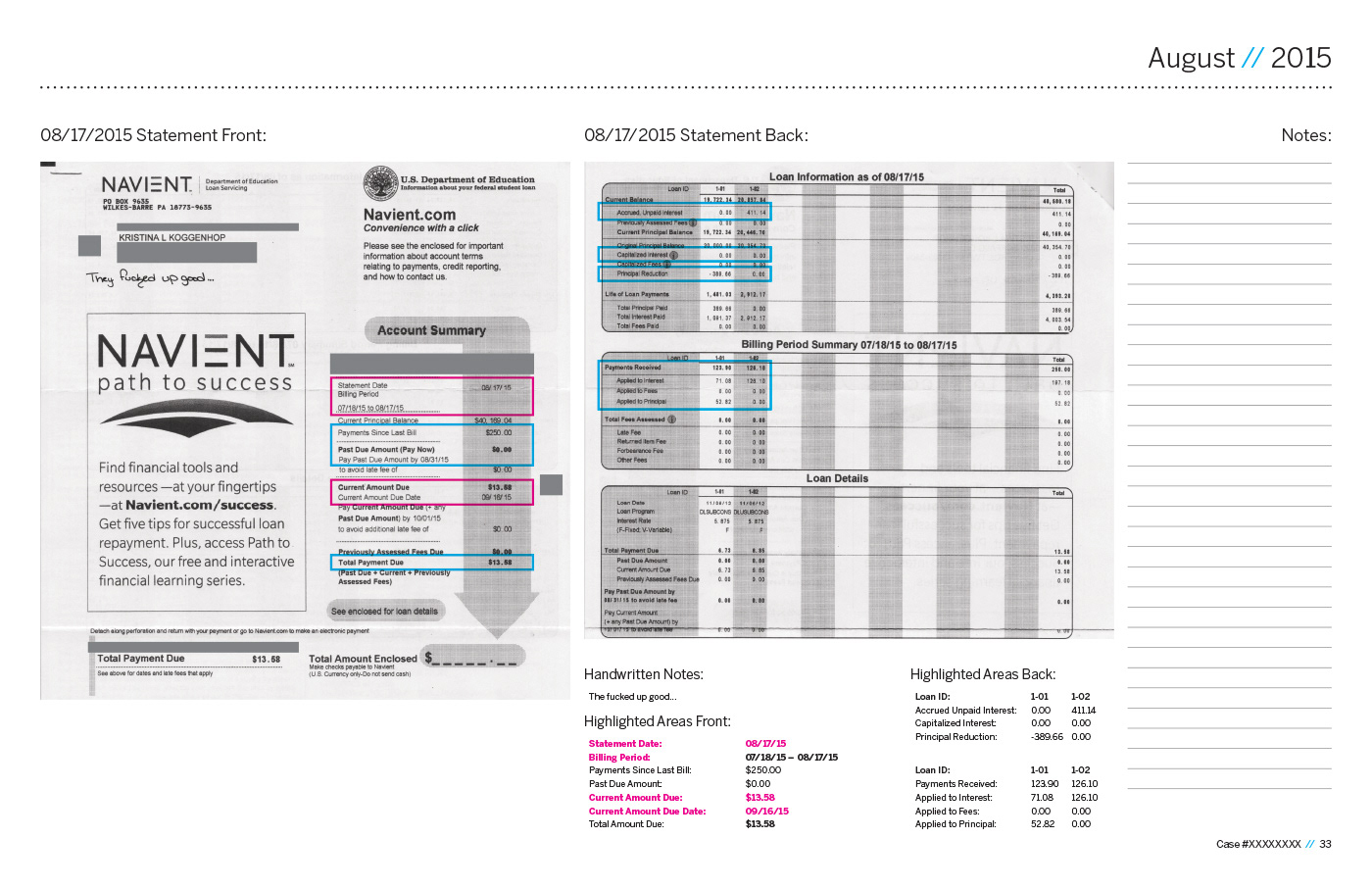

Page 33

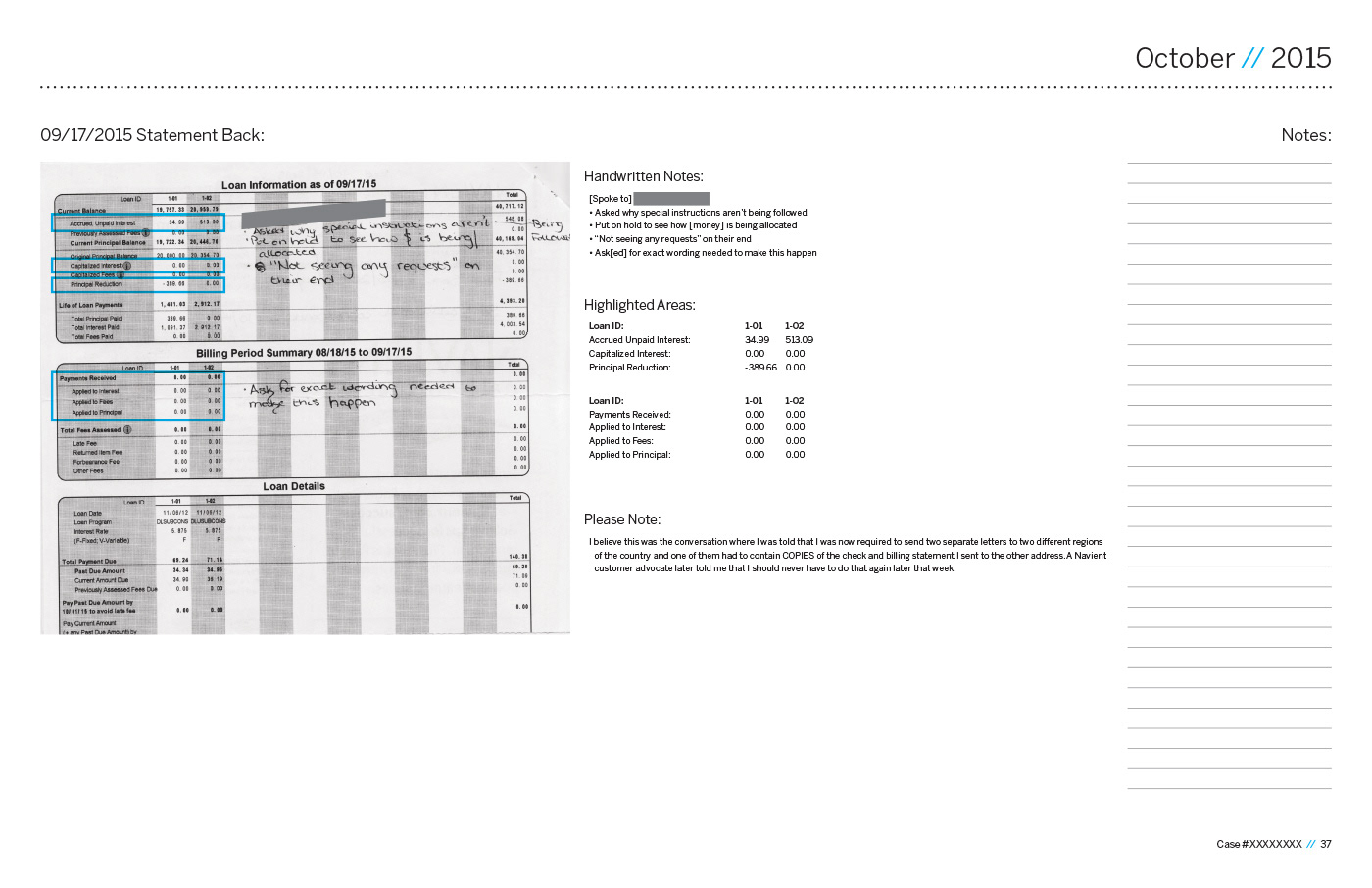

Page 36

Page 37: This phone call was when I was first told that I would have to send TWO correspondences to Navient; one to where I was making payments to and one to their office in Wilkes-Barre, PA. I complied, but was pretty pissed that I was actually being told that I would have to keep doing this.

Page 38

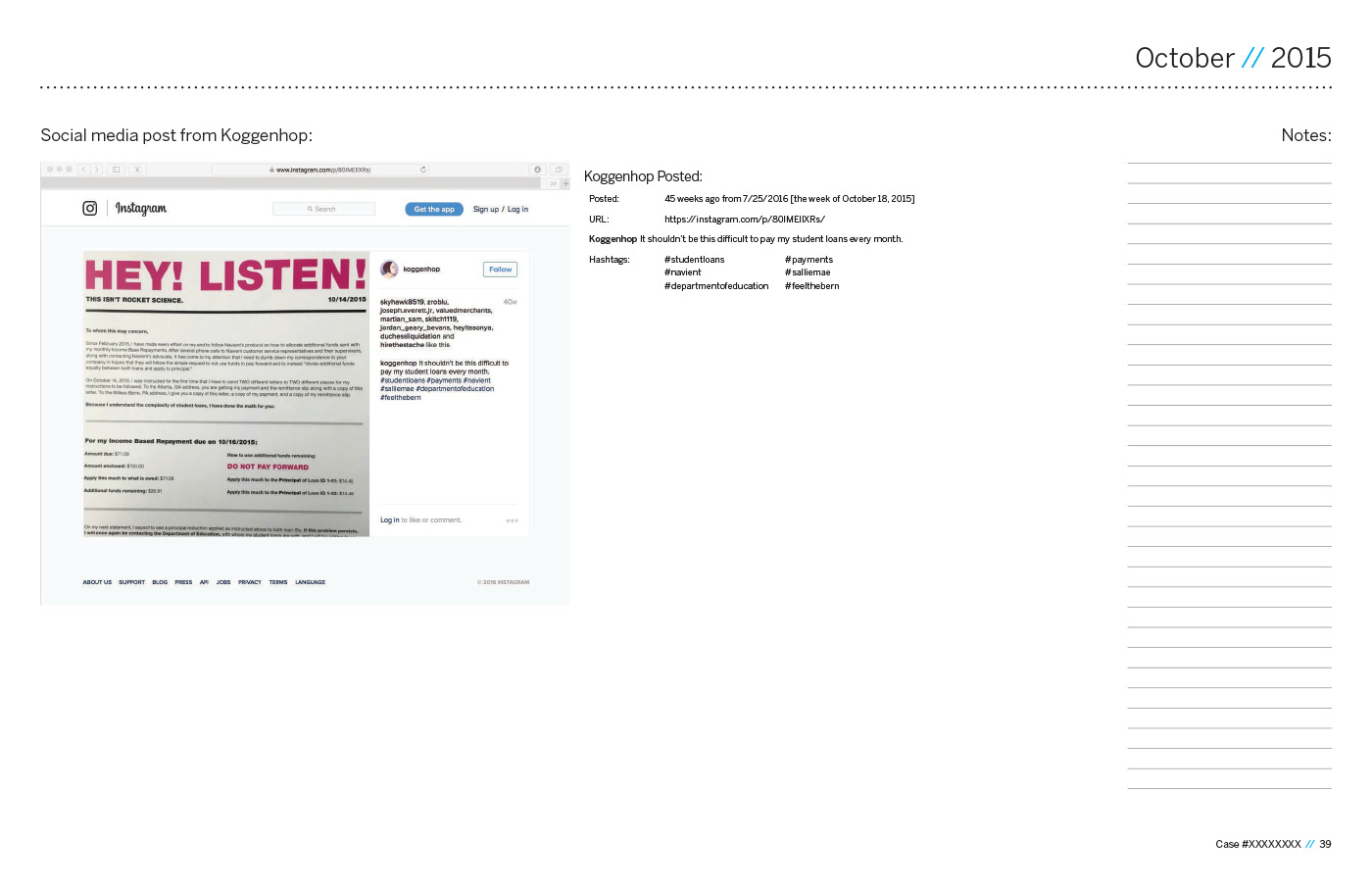

Page 39: After posting this to social media, Navient reached out to me in order to "resolve" the issue.

Pages 40 and 42 depict the experience in talking to the Navient Customer Advocate that was assigned to my case. They include personal thoughts on the professionalism of this person and how they handled the situation, as well as the excuses they gave me for why the problem was happening. In addition, they gave me personal opinions (and emphasized that they were opinions) and advice on how to move forward, which I followed.

Additionally, they informed me for the first time that unless all of the interest was paid on both loan IDs, no money that I sent would apply to the principal of my loans, which contradicts what I had been told in every conversation I had with Navient up until that point. That said, Navient had always applied some money to the principal of Loan ID 1-01 despite a significant amount of interest on Loan ID 1-02. They tried to tell me that interest was capitalizing and the government was paying the interest Loan ID 1-01, but they had never (and to this day, have not) reported any capitalization of interest on either loan, and the principal balance owed has never changed unless money I had sent was applied to the principal, thus lowering that amount.

With that in mind, I would have accepted the answer I was given if it matched the numbers I had been given. However, nothing was adding up, so I refused to stop questioning it.

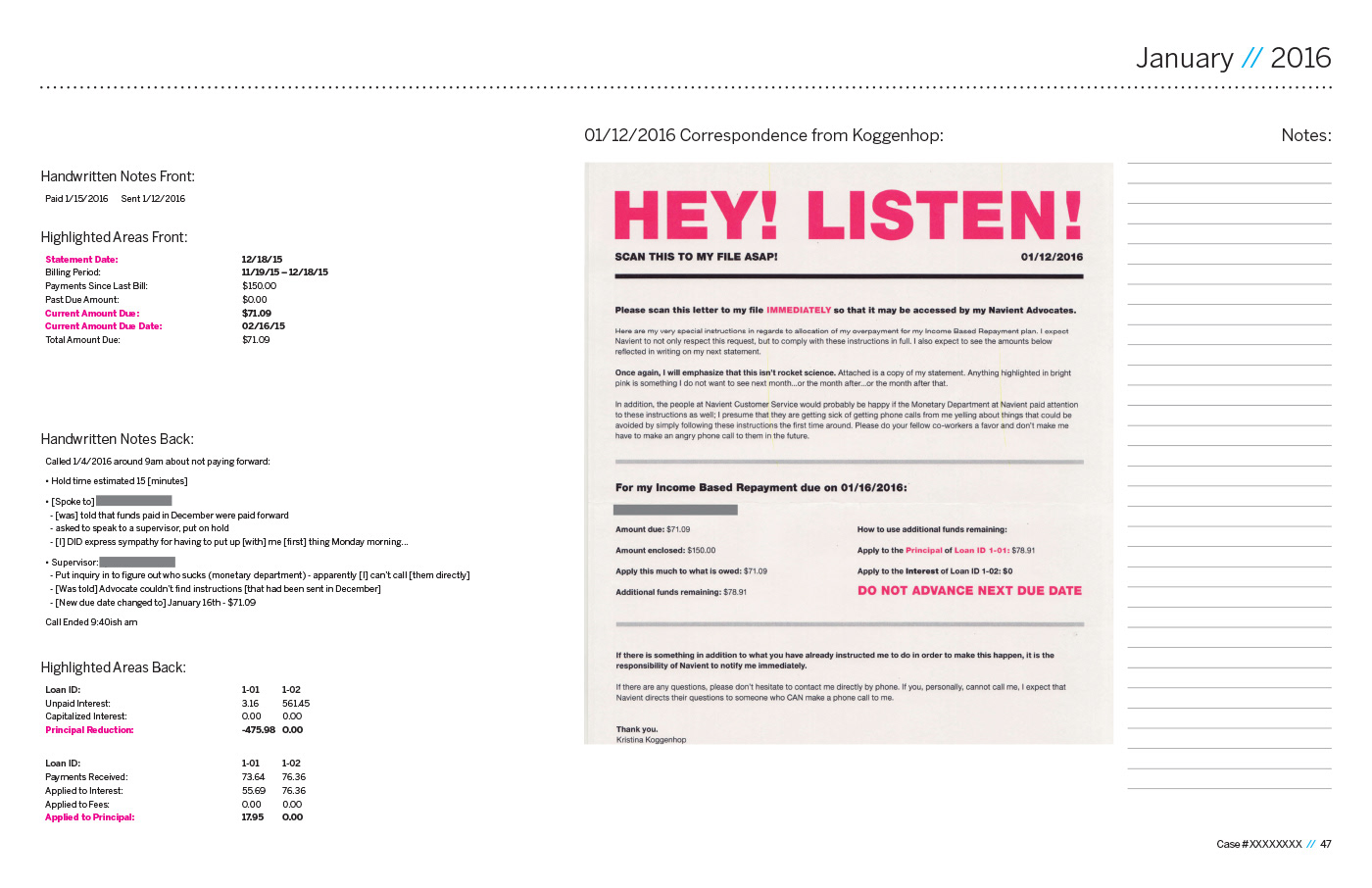

Page 46

Page 47

Page 52

Page 53 details a call I made to the Department of Education Ombudsman Group (1-877-557-2575). The person I talked to essentially said that they wouldn't get involved yet, and that this was my problem. After explaining to them that I have tried to resolve the problem of being put in a paid ahead status for the past year on my own, I asked what else I was expected to do after complying with every protocol given to me by Navient. The answer: if I had the free time, I could research federal student law and quote it to Navient each and every time I call them, or I could contact my House Rep. or state Senator for additional help.

Worst. Answer. Ever. They wouldn't even given me the names of bills to look up, telling me I was on my own.

My response? I spent weeks digging through federal law related to education, finance, and consumer protections. I looked up every agency that possibly had a link to my student loans from the Department of Education to the Treasury, the IRS to Fiscal Services. I actually read in its entirety the Higher Education Opportunity Act of 1965 and it's amendments, along with the Dodd–Frank Wall Street Reform and Consumer Protection Act and the Student Aid and Fiscal Responsibility Act (SAFRA). I may not have gone to school for law, but I have taken multiples classes on how to read and understand them, as well as to pick apart the specific wording used within for additional context.

Additionally, I did look in to contacting my representatives, who include Dave Trott (R), House Representative of Michigan's 11th District and Senators Gary Peters (D) and Debbie Stabinaw (D). However, none of my reps sit on any committees related to student loans, and to be honest, I wasn't sure how far I would really get with them during an election year. I really didn't want to have to resort to contacting my rep so quickly, being as I personally see it as a step closer to the last resort, and I thought it may be the best move to exhaust all of my options before going down that road.

During this research period, I stumbled upon the Consumer Financial Protection Bureau and decided that if things got worse, the next step was going to be to launch a complaint with them.

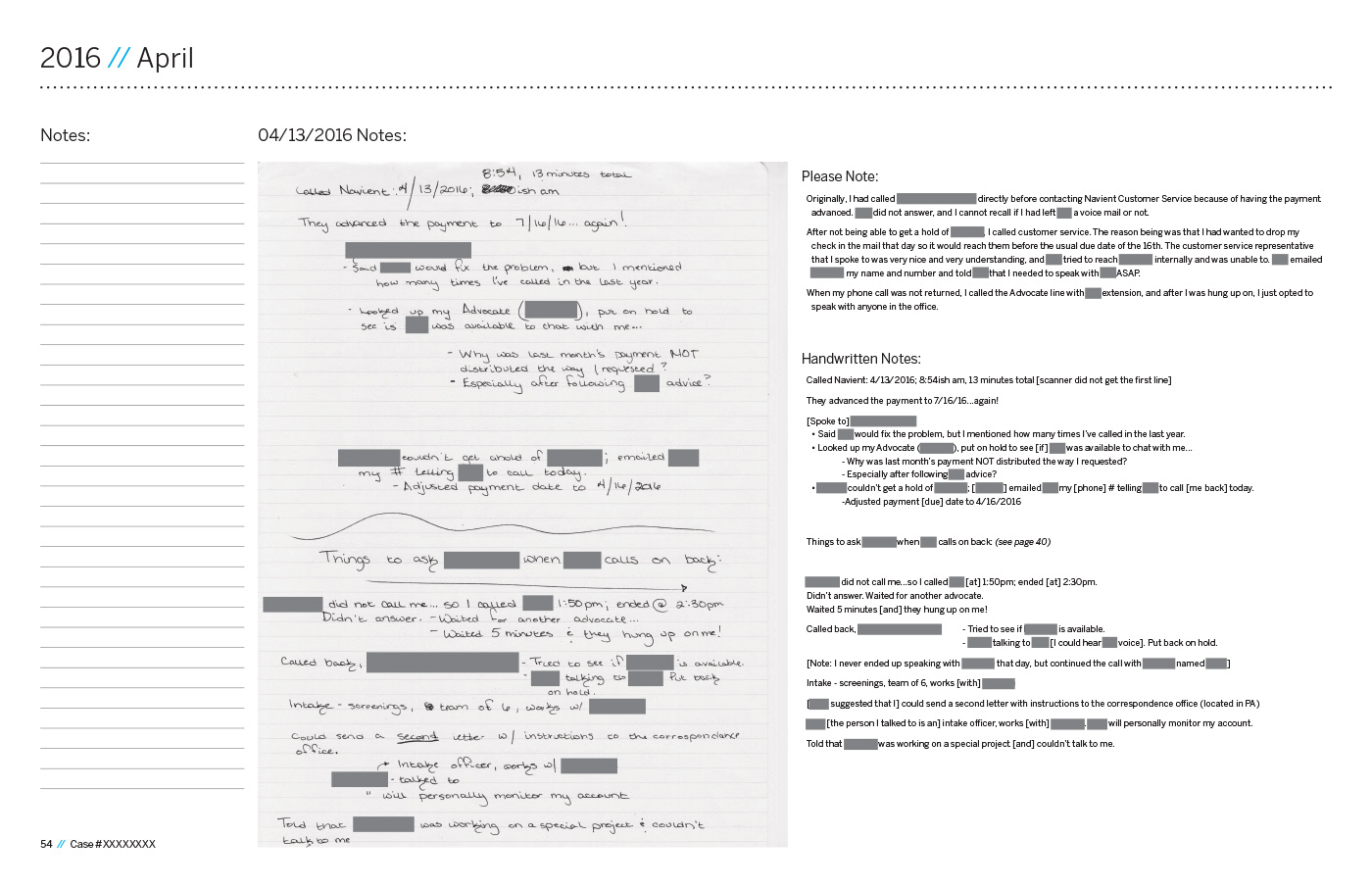

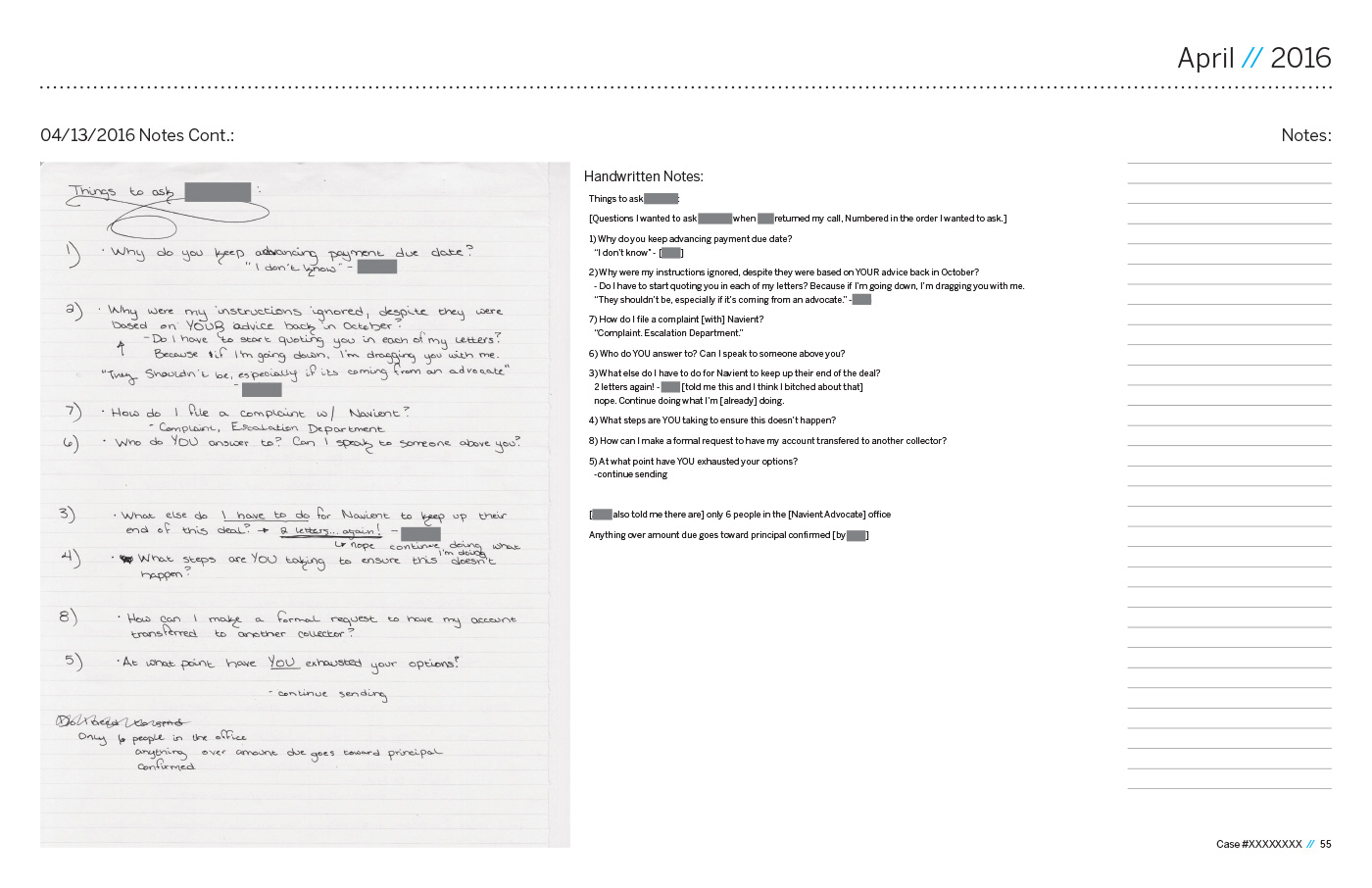

Page 54: Notes from call made to the Navient Customer Advocate that had contacted me in October 2015, whom I was told was too busy to talk to me by an intake officer.

Page 55

Page 57: Social media posts related to the research I did.

Page 59: A voice mail left by the intake officer that I had previously spoken to.

I would like to take a moment to clear something up for anyone unclear as to what the IBR renewal process is: When you are on an Income-Based Repayment plan (IBR), you must renew your status annually. What that means is you send your federal loan servicer any and all documents declaring your income. Most commonly, what you send over is your federal tax return from the previous year, your servicer looks at your Adjusted Gross Income, and your monthly payment for your federal loans for the next year will not exceed 10% of your income.

My previous renewal period had been in August 2015, and the payment plan didn't kick in until October 2015. This has been the same timeframe every year in the past since 2013 (my first renewal). When this voice mail was left, I was 6 months in from the start of my previous renewal start date. I had no reason to be up for renewal at that point in time, and yet Navient was claiming that I had yet to file my paperwork for the next year. I've never been notified before June that it was time to start filling out the paperwork for renewal, so this call came as a complete surprise.

I distinctly remember laughing when I listened to the message, threw my hands in the air, and said, "Fine! Bring it." At that point, I knew that what they were telling me was not only untrue, but they were willing to do whatever it took to get me to stop asking questions. I figured that the paperwork would be on the way and I would send it back immediately when I got it. Aside from this single voice mail, Navient had never notified me that they were intending to violate my IRB contract earlier than scheduled.

It was after this that I submitted a complaint to the CFPB, briefly mentioning it at the tail end.

Page 64: That next month's statement. I was still waiting for the paperwork that never came.

Page 65: The fallout - Navient admits to violating the terms of my IBR contract.

Not only had Navient violated my IBR contract, they tried to blame me for it. In case you don't know, it is written in to the law that there is absolutely no penalty for making overpayments on any repayment plan. However, Navient claimed for the first time that because I had sent extra money every month, I had "expedited the time frame for IBR renewal." Basically, I told the customer service rep that Navient was in violation of our contract, specifically stating that nowhere does it say that if I pay over the amount required, I have to renew my plan earlier than scheduled. However, the second I started using the term "contract violation," the rep changed my account back to have the plan be renewed in August and told me that they would personally monitor the account.

Unfortunately, this conversation happened after I submitted a complaint to the CFPB. A week later, I spoke to a different customer service rep who told me that my plan was not up for renewal for another four months and I would be receiving notification about the renewal soon.

When I questioned the Department of Education about this claim about an expedited renewal process, I was met with complete shock and a, "They can't do that." The person I spoke to even put me on hold to confirm that rules and regulations pertaining to IBR plans had not recently changed, which they had not.

Page 70: First official renewal notice.

Page 71: This is when I realized that Navient had "expedited" my renewal time the previous year, but had never acknowledge it when I called them up yelling.

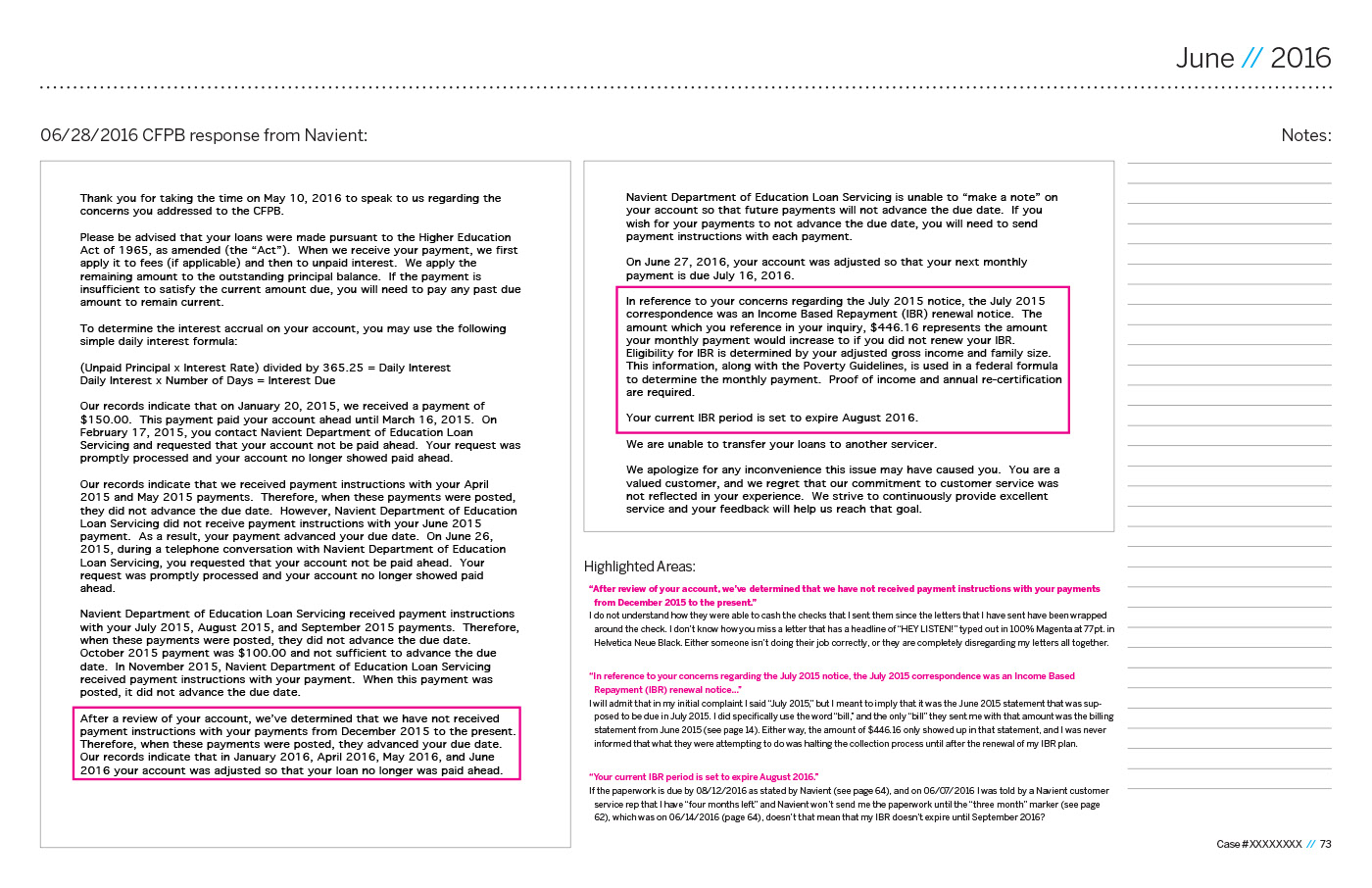

Page 73: Navient's response to my CFPB claim.

This is what really pissed me off the most. In response to my complaint to the CFPB informing them that no matter what I do, Navient continues to put me in a paid ahead status despite being given very specific instructions not to (mailed around the check every single month), Navient told a branch of the federal government that they had not received my correspondences, and without saying it, called me a liar. I was absolutely lived, got on the phone with the CFPB (1-855-411-2372), and was told that I could only dispute Navient's response once and that was it. I was not happy with that response, but I had 60 days from that date to do it.

What happened next was a trick I learned in art school: change one thing. If neither the Department of Education or the CFPB could help me, I was going to contact another agency. If that didn't work out, pick another and try again. Still didn't work? Find another. I ended up speaking with 7 different sub-departments within Education and Treasury before finally being handed back over to the Ombudsman Group. This time, after telling them exactly who I was calling and insisting that I wasn't going to stop, I was referred to another part of the Department of Education. This final phone call happened on the Thursday before the Fourth of July weekend, and was told to expect a phone call within the next three weeks from someone else. Surprisingly, that call came on the following Tuesday from a Research Specialist.

Navient was then notified that someone at the Department of Education was looking in to my case.

Page 74

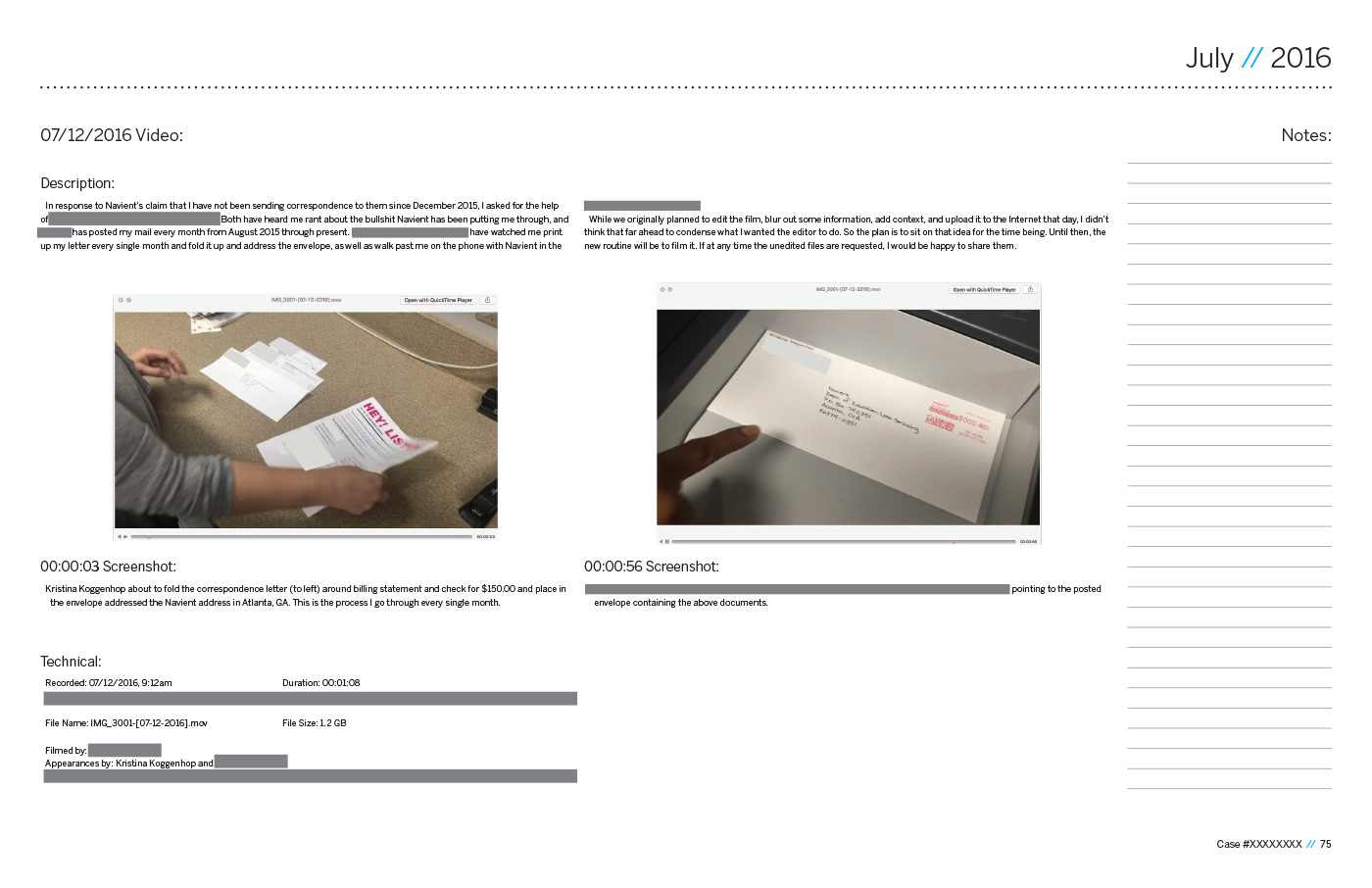

Page 75: This video was sent to the Department of Education on a flash drive along with this book.

Despite the fact that Navient was aware of the Department of Education looking in to my case against them, I did not trust that they were actually going to comply with the letter I sent along with my July payment. Call me paranoid, but I had a friend record me stuffing and sealing the envelope, and then post the mail. I was originally going to start posting monthly videos of myself doing this, but the editing (to conceal specific information shown) was going to be a bit tricky and I can't keep up on it. However, I knew that if it came back to me that this bill in particular was paid ahead, I had a direct contact with a single person that I could send this evidence to.

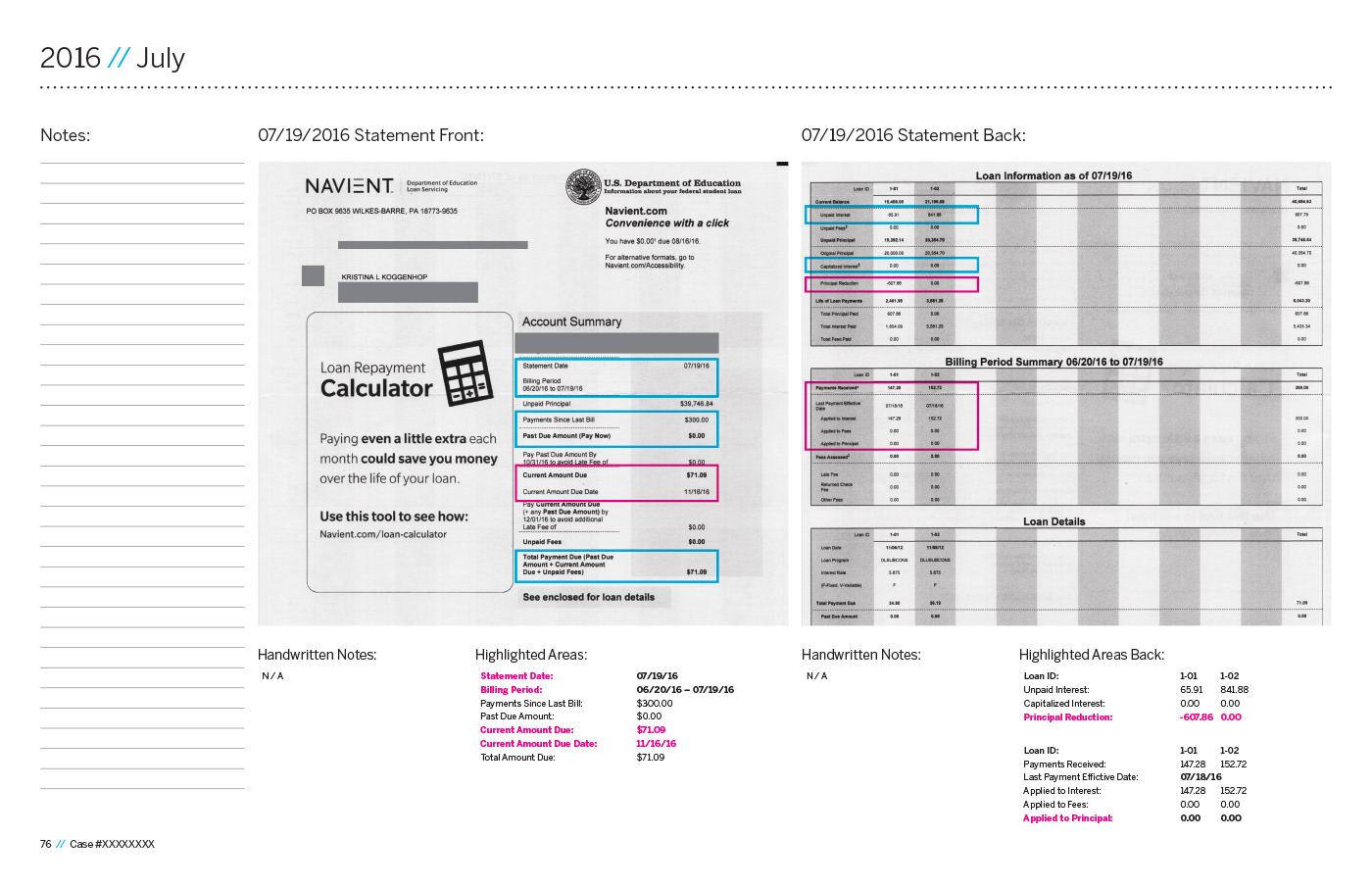

Page 76: Paid ahead again.

A few weeks later, the Research Specialist came back to me to tell me that after going through the documentation that Navient had supplied, everything was adding up on their end. Unless I could prove otherwise that I had actually sent Navient the instructions telling them not to put me in a paid ahead status, it was my word against theirs. They suggested I contact the Office of the Navient Customer Advocate, and when I informed them that I had already spoken to four people within that office over the last year and I was still having the problem, it finally seemed to click with someone that there was a much bigger problem that needed to be addressed.

My response was, "I have copies of everything. Give me a few days to compile it and I'll send it over."

Unfortunately, it took about two weeks to put everything together. The amount of documentation that I had was enough to overwhelm most, and I figured that the best way to present this was to put it together in a book, showing the timeline of what Navient was doing to me, and pointing out all of the patterns that I was seeing. I was in the middle of putting this book together when I received the above statement.

Page 77: Notes from a call made to Navient asking about the paid ahead status.

Yes. Navient had received my payment. No, Navient "had not received" my correspondence. Once again, my account was put in to a paid ahead status against my wishes while the Department of Education was looking in to my case over this exact problem.

Because I had been up to my ears in documentation, I was at a point where I had a lot of the numbers that Navient was reporting to me memorized. When I opened this statement and looked at the back, I noticed that the amount listed for "Principal Reduction" had suddenly jumped from about $475 to $607. As of March 2017, that number has gone up again to $809, with absolutely no documentation of where that money came from. Any time I question it, I am never given a solid answer. I have received three payment histories since them from Navient, but when I compare the numbers to the statements, there are very few that actually match. It appears as if someone has gone in to my account and really fudged some numbers, and I wouldn't complain about it if I didn't know that it could come back to bite me in the ass later on.

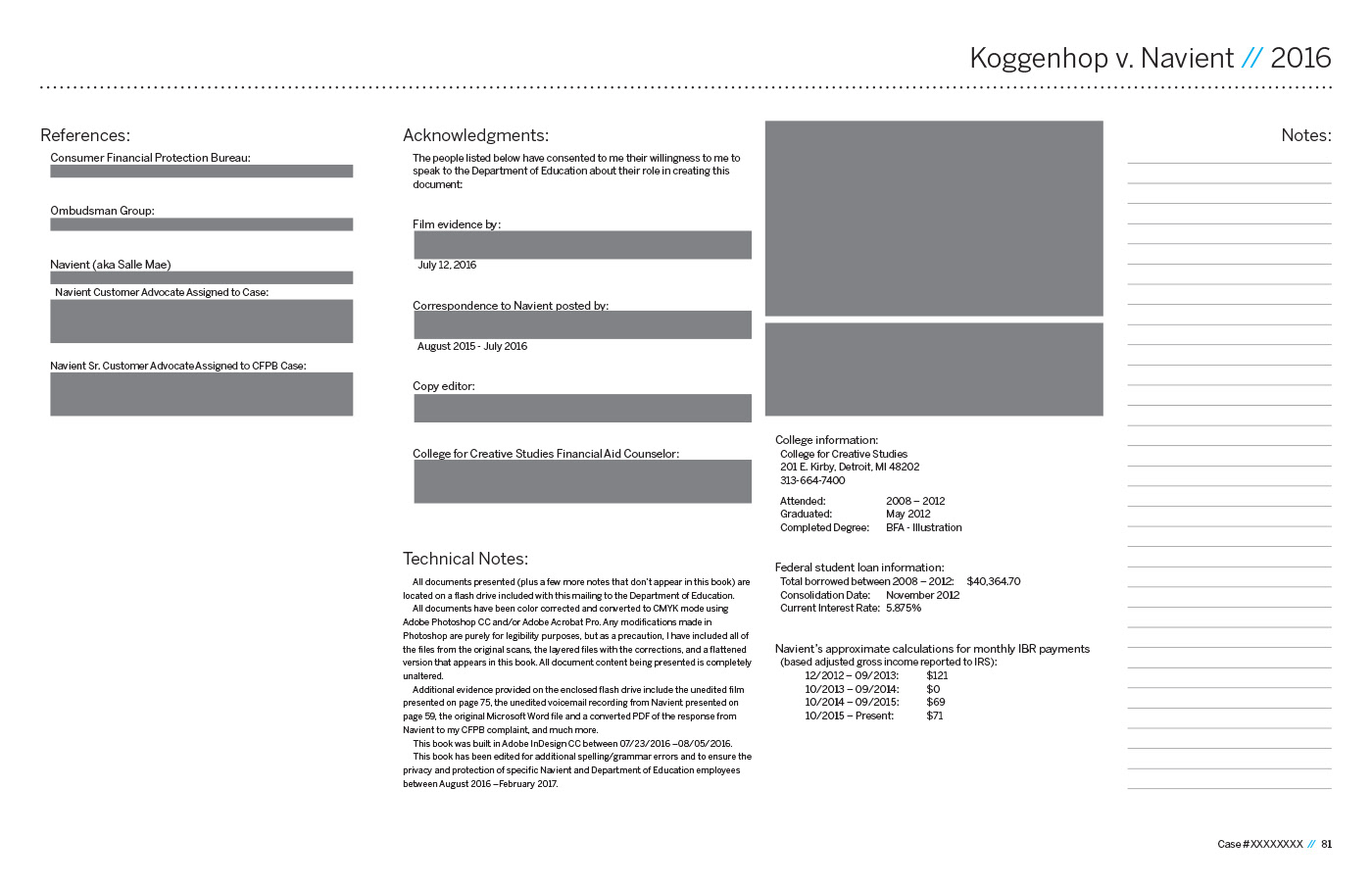

Page 81

The Fall Out:

Three copies of this book were printed and spiral bound for presentation. One was sent to my contact at the Department of Education. Another was sent to the CFPB to dispute Navient's response to my complaint. The third is sitting here next to me, hanging out, waiting to be used again in the future.

Between the time I had mailed the books off and heard back from the Department of Education, Navient called to inform me that they were launching an internal investigation into the people responsible for processing my payments: Bank of America. This was the first time I had ever heard of Bank of America being involved in any of my student loans, and to be blunt, when Navient told me that they contract Bank of America to process all of their federal loan payments and that I'm sending my checks to Bank of America directly (despite being told to address the envelope to Navient), my first instinct was to laugh. I could not believe what they were telling me, and I actually found it funny that they thought if one of the biggest banks in the country was now involved, I would stop questioning what they were doing.

When I was finally contacted by the Department of Education about the book I had sent them, they told me that because of all the documentation that I had provided, multiple investigations had since been launched in to Navient's business practices, focusing on how payments were being processed. They confirmed the Bank of America story to me, and the person talking to me told me that they had no clue of their involvement before this case.

I was also told that when the Department of Education received their copy, there was some sort of party in the mailroom where a bunch of employees were going through it, impressed with what was actually sent. Apparently, most people don't normally go to the lengths that I did to prove my case, and they don't expect to get anything like what I provided them with ever again.

Officially, I won my case with the Department of Education, and they instructed Navient to go back through my account and make adjustments based on the evidence I had provided them. I was told it wasn't going to be a process that would be completed overnight, and to be honest, I wasn't expecting it. In addition, I was told that if problems with Navient continue moving forward, the Department of Education invited me to contact them directly in the future.

As of May 2019:

Lots of things have changed. My case has been assigned to probably the ONLY person in the entire company that seems to give a damn, and I refer to her publicly and positively as "Grandma Navient." I think very highly of her because I have not had a single problem since I started working with her. We talk at least once a month to make sure that the above issues do not happen.

The solution? Grandma Navient looks at my account once a month to make sure that nothing is paid ahead. It's a simple solution that really should have been dealt with from the beginning.

I've also had Navient purchase my Chase Student Loans and they are now the people that I deal with for my repayment period there. Grandma Navient has been incredibly supportive when giving me information about that loan, and has gone above and beyond to make sure issues like what happened with my federal loan do not repeat itself with this one. While I still dread dealing with Navient, it has become significantly less of a chore and I haven't had a reason to get upset. Grandma Navient has made life just a little easier, and I keep encouraging Navient to give her a massive raise.

One of the best things I learned in art school was that it's okay to fail, and I failed quite a bit throughout this endeavor. However, I was taught that when you fail, you move on to the next project. Just because one idea fails, it doesn't mean that it can't inspire another, and another, and then one after that. You keep going until you succeed, exhausting every single option. You never give up until you find what works.

To be honest, while this may not look like the most beautiful piece in my portfolio, it is the one that I am most proud of. I wasn't willing to give up and went above and beyond to prove my case. I had to fight for not only myself, but millions of other borrowers who have probably had to deal with the same issues that I did. I did this because it was the right thing to do, and I would do it again in a heart beat.